#Rainfall Deficit 2024

Explore tagged Tumblr posts

Text

Jharkhand Faces Weak Monsoon, Raising Agricultural Concerns

Rainfall 49% Below Normal As Dry Spell Expected To Continue Until July 13 Weather patterns threaten crop health and water availability across 24 districts. RANCHI – Jharkhand is experiencing a significantly weakened monsoon, leading to increased heat and humidity across the state. The Meteorological Department forecasts no substantial rainfall until July 13, exacerbating agricultural…

#Agricultural Crisis Jharkhand#राज्य#Climate Impact Agriculture#Crop Health Concerns#Jamshedpur Weather News#Jharkhand Weak Monsoon#Meteorological Department forecast#Pakur District Drought#Rainfall Deficit 2024#Ranchi Weather Patterns#state#Water Availability Jharkhand

1 note

·

View note

Text

'The Amazon rainforest entered the dry season already with a water deficit due to the 2023 drought,' says expert

The extreme drought stems from the 2023 El Niño and the loss of Amazon rainforest areas

“The drought is killing the coffee plantations,” laments family farmer Gersi de Souza, a resident of Acrelândia in Acre state, one of the 3,978 Brazilian municipalities affected by the current drought. “Last year, we were already in a tough situation. And the situation has become more complicated this year,” he says. This is the worst drought in 70 years in Brazil, according to data from the National Center for Monitoring and Alerts of Natural Disasters (CEMADEN, in English) of the Ministry of Science, Technology and Innovation.

Researchers interviewed by Brasil de Fato believe that the phenomenon results from the influence of El Niño, which affected Brazil in 2023, and growing deforestation in the Amazon, which intensified during the Bolsonaro administration. “From 2019 to 2022, we lost 50,000 km² of primary forest, apart from secondary forest,” explains Luciana Gatti, coordinator of the greenhouse gas laboratory at the National Institute for Space Research (INPE, in Portuguese). Primary forests are the native forests of a biome, while secondary forests are those that have grown in a previously deforested area. “We haven’t recovered the 50,000 square kilometers of forest lost, and we haven’t zeroed out deforestation either,” she warns.

El Niño, characterized by the warming of the waters of the Pacific Ocean, has reduced rainfall in the Amazon rainforest, bringing a dry summer to the region in 2023. “We saw fish deaths, dolphins, riverine populations, and Indigenous peoples isolated and having difficulty accessing high-quality water and transportation,” says Helga Correa, a conservation specialist at the NGO WWF Brasil. In 2024, the drought in the Amazon came earlier than expected, without the biome recovering from the previous drought. “We didn’t have enough rain in the wet season, and we entered the dry season with a water deficit,” she explains.

Continue reading.

#brazil#brazilian politics#politics#environmentalism#environmental justice#amazon rainforest#image description in alt#mod nise da silveira

11 notes

·

View notes

Text

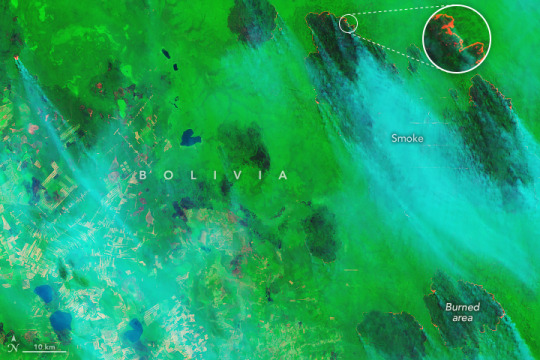

Smoke Fills South American Skies

Intense fires burning in several South American countries draped large swaths of smoke across the continent throughout August and early September 2024. In Brazil and Bolivia, fire activity reached levels not seen since 2010 as a prolonged drought parched landscapes in both countries.

From about 1 million miles (1.6 million kilometers) away from Earth, NASA’s EPIC (Earth Polychromatic Imaging Camera) imager on the DSCOVR (Deep Space Climate Observatory) satellite captured this view of smoke billowing from the blazes on September 3, 2024.

Smoke from fires in Brazil swept over the country’s capital city in mid-August and early September. For several days, São Paolo’s air was clouded with smog, and air quality was unhealthy for sensitive groups, according to AirNow. The smoke grounded flights and forced schools to close in the most populous city in Brazil, according to The Guardian.

The fire season in the southern Amazon, which generally ramps up in August and peaks in September and October, has been intense this year. According to the Copernicus Atmosphere Monitoring Service (CAMS), a component of the European Union’s space program, emissions from fires have been exceptionally high in Bolivia and the Brazilian states of Amazonas and Mato Grosso do Sul.

CAMS estimates near-real-time wildfire emissions using its Global Fire Assimilation System (GFAS), which aggregates observations made by the MODIS (Moderate Resolution Imaging Spectroradiometer) sensors on NASA’s Aqua and Terra satellites. Compared to the previous 21 years, these areas have registered their highest year-to-date total emissions, at 44, 22, and 13 million metric tons of carbon, respectively.

The Pantanal region—which straddles the Brazil-Bolivia border and is home to one of the world’s largest tropical wetlands—has been especially hard hit in 2024. Early and intense blazes spread over the wetlands in late May and continued into August. According to Brazil’s National Institute for Space Research (INPE), there were a record number of fire detections in the biome in June 2024, and fires have continued to burn at high levels since.

The false-color image above, acquired by the OLI (Operational Land Imager) on Landsat 8, shows fires near Ascensión de Guarayos, in the Bolivian state of Santa Cruz. The false-color image emphasizes the burn areas (brown) from several fires on September 3, 2024. Unburned vegetation is green. Near- and short-wave infrared bands help penetrate some of the smoke to reveal hot areas associated with active fires, which appear orange.

Through September 6, blazes tore through more than 10 million hectares of Bolivia, or roughly 9 percent of the country’s total area. Out of the 42 million metric tons of carbon emitted in Bolivia between May and August, 33 million metric tons came from fires in the state of Santa Cruz, according to Mark Parrington, CAMS senior scientist with the European Centre for Medium-Range Weather Forecasts (ECMWF).

Large parts of South America have seen significant rainfall deficits over the past three months. According to ECMWF, this has led to “exceptional drought” (the highest drought ranking) over much of the central and northern parts of the continent. Brazil’s Natural Disaster Monitoring and Alerts Center noted on September 5 that shifted rainfall patterns from El Niño, increased temperatures from climate change, and reduced humidity from deforestation have all contributed to the drought.

NASA Earth Observatory images by Michala Garrison, using data from DSCOVR EPIC and Landsat data from the U.S. Geological Survey. Story by Emily Cassidy.

2 notes

·

View notes

Text

The Growth of Africa’s Agricultural Machinery Industry: Driving Agricultural Productivity

Africa's agricultural machinery market is poised for significant growth, with its market size estimated at USD 2.27 billion in 2024 and expected to reach USD 3.09 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.40% during the forecast period (2024-2029). This surge is driven by the growing need to modernize farming practices and enhance agricultural productivity across the continent. Agriculture remains the backbone of many African economies, contributing significantly to employment and GDP, and the demand for advanced machinery is increasing as farmers seek more efficient ways to cultivate crops and manage resources.

Market Overview

The agricultural machinery market in Africa is evolving rapidly, underpinned by a combination of factors like increasing mechanization, government support, and the rising adoption of modern technologies. Traditionally, agriculture in Africa has relied heavily on manual labor, but with increasing pressure to meet the food demands of a growing population, the need for mechanized solutions has become critical.

Farmers are now seeking to adopt machinery such as tractors, combine harvesters, planters, and irrigation equipment. These machines not only reduce labor intensity but also significantly improve yields by ensuring timely planting, efficient harvesting, and better resource management. The market is also witnessing increased interest in precision agriculture technologies that integrate machinery with data analytics, drones, and GPS systems to optimize field operations.

Key Drivers of Market Growth

Government Initiatives: Several African governments have launched initiatives aimed at boosting agricultural productivity through mechanization. Subsidies, low-interest loans, and tax incentives for machinery imports are becoming common, providing farmers with the financial means to invest in modern equipment.

Rising Population and Food Demand: The continent’s population is expected to reach 2.5 billion by 2050, leading to a substantial rise in food demand. This growth is putting pressure on African farmers to produce more food efficiently, driving the demand for agricultural machinery that can facilitate large-scale, high-yield farming practices.

Technological Advancements: The introduction of innovative technologies, such as smart tractors, precision farming tools, and automated equipment, is helping farmers increase productivity. These technologies not only reduce operational costs but also enhance sustainability by minimizing wastage and optimizing resource use.

Access to Finance: Improved access to finance through government programs and private sector partnerships is making it easier for small and medium-sized farmers to afford agricultural machinery. Microfinance institutions and agricultural banks are also offering specialized loans aimed at promoting mechanization.

Challenges Facing the Market

Despite the positive growth prospects, the African agricultural machinery market faces several challenges:

High Initial Costs: The cost of purchasing agricultural machinery remains a significant barrier for many smallholder farmers. While government subsidies and financing options exist, they are not always accessible to everyone.

Infrastructure Deficits: Poor infrastructure, including roads and electricity in rural areas, hampers the efficient use and maintenance of machinery. This makes it difficult for farmers to fully leverage mechanized equipment, particularly in remote regions.

Limited Technical Know-How: The lack of technical skills required to operate and maintain agricultural machinery is another challenge. Many farmers are unfamiliar with advanced equipment, and access to training and support services is often limited.

Climate Variability: Africa’s agriculture is highly dependent on rainfall, and the increasing unpredictability of weather patterns due to climate change poses a risk to agricultural investments, including machinery. Irrigation equipment and climate-resilient technologies will play a crucial role in mitigating these risks.

Future Outlook

The Africa agricultural machinery market is poised for significant growth in the coming years. With more governments focusing on agricultural mechanization as a strategy for food security and rural development, and the increasing penetration of global machinery brands into African markets, the industry is set to expand. Innovations in equipment tailored to the specific needs of African soils and climates are also expected to drive adoption.

Moreover, as Africa continues to urbanize and industrialize, the trend towards commercial farming will intensify, further fueling the demand for advanced agricultural machinery. The growing focus on sustainability will also lead to increased demand for equipment that promotes eco-friendly farming practices, such as machines designed to optimize water use and reduce soil degradation.

Conclusion

The agricultural machinery market in Africa holds immense potential as the continent strives to modernize its farming practices. As mechanization continues to be a key driver of agricultural productivity, the market is set to play a critical role in Africa’s journey towards food security, economic development, and rural transformation. The future of agriculture in Africa is mechanized, and as the industry evolves, it will be instrumental in shaping the continent’s agricultural landscape.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence https://www.mordorintelligence.com/industry-reports/africa-agricultural-machinery-market

#marketing#agricultural machinery market#agricultural machinery market size#agricultural machinery market share#agricultural machinery market trends#agricultural machinery market growth#agricultural machinery market report

0 notes

Text

Crude Oil Prices See Support from Positive US GDP Report

September arabica coffee (KCU24) is up +2.05 (+0.89%), and Sep ICE robusta coffee (RMU24) is up +43 (+0.99%).

Coffee prices today are rebounding higher on some short-covering after the sharp sell-off seen in the past 2 weeks to new 2-week lows early today. Coffee prices are seeing support today from the slightly weaker dollar and the lack of rain last week in Brazil.

The lack of rain last week in Brazil is supportive for arabica coffee prices. Somar Meteorologia reported Monday that Brazil's Minas Gerais region received no rain last week, versus the historical average for the week of 2.6 mm. Minas Gerais accounts for about 30% of Brazil's arabica crop.

Coffee harvest pressures in Brazil are bearish for coffee prices. Safras & Mercado reported last Friday that Brazil's 2024/25 coffee harvest was 74% completed as of July 16, faster than 66% last year at the same time and faster than the 5-year average of 70%. Brazil is the world's largest producer of arabica coffee beans. However, Safras & Mercado cut its Brazil 2024/25 coffee output estimate to 66 million bags from a previous estimate of 70.4 million bags, citing above-average temperatures and drought that compromised coffee yields.

A rebound in ICE coffee inventories from historically low levels is negative for prices. ICE-monitored robusta coffee inventories rose to a 1-year high Wednesday of 6,478 lots, up from the record low of 1,958 lots posted in February 2024. Also, ICE-monitored arabica coffee inventories rose to a 1-1/2 year high on June 25 of 842,434 bags, up from the 24-year low of 224,066 bags posted in November 2023. Arabica inventories on Tuesday were mildly below that 1-1/2 year high at 813,378 bags.

Robusta coffee prices are underpinned by fears that excessive dryness in Vietnam will damage coffee crops and curb future global robusta production. Coffee trader Volcafe said on May 22 that Vietnam's 2024/25 robusta coffee crop may only be 24 million bags, the lowest in 13 years, as poor rainfall in Vietnam has caused "irreversible damage" to coffee blossoms. Volcafe also projects a global robusta deficit of 4.6 million bags in 2024/25, a smaller deficit than the 9-million-bag deficit seen in 2023/24 but the fourth consecutive year of robusta bean deficits.

Vietnam's agriculture department said on March 26 that Vietnam's coffee production in the 2023/24 crop year would drop by -20% to 1.472 MMT, the smallest crop in four years, due to drought. Also, the Vietnam Coffee Association said that Vietnam's 2023/24 coffee exports would drop -20% y/y to 1.336 MMT. The USDA FAS on May 31 projected that Vietnam's robusta coffee production in the new marketing year of 2024/25 will dip slightly to 27.9 million bags from 28 million bags in the 2023/24 season.

Smaller coffee exports from Vietnam, the world's largest robusta coffee producer, are bullish for prices. The General Department of Vietnam Customs reported July 9 that Vietnam's June coffee exports fell -11.5% m/m and -50.4% y/y to 70,202 MT, the smallest amount of coffee exports for the month of June in 13 years. Also, Vietnam's Jan-June coffee exports were down -11.4% y/y at 893,820 MT.

The International Coffee Organization (ICO) reported on July 5 that global May coffee exports rose +9.8% y/y to 11.78 million bags, and Oct-May global coffee exports were up +10.9% y/y to 92.73 million bags. Cecafe reported July 11 that Brazil's 2023/24 coffee exports rose +33% y/y to a record 47.3 million bags.

In a bearish factor, the International Coffee Organization (ICO) projected on May 3 that 2023/24 global coffee production would climb +5.8% y/y to 178 million bags due to an exceptional off-biennial crop year. ICO also projects global 2023/24 coffee consumption will rise +2.2% y/y to 177 million bags, resulting in a 1 million bag coffee surplus.

The USDA's bi-annual report released on June 20 was bearish for coffee prices. The USDA's Foreign Agriculture Service (FAS) projected that world coffee production in 2024/25 will increase +4.2% y/y to 176.235 million bags, with a +4.4% increase in arabica production to 99.855 million bags and a +3.9% increase in robusta production to 76.38 million bags. The USDA's FAS forecasts that 2024/25 ending stocks will climb by +7.7% to 25.78 million bags from 23.93 million bags in 2023/24. The USDA's FAS projects that Brazil's 2024/25 arabica production would climb +7.3% y/y to 48.2 mln bags due to higher yields and increased planted acreage. The USDA's FAS also forecasts that 2024/54 coffee production in Colombia, the world's second-largest arabica producer, will climb +1.6% y/y to 12.4 mln bags.

0 notes

Text

Once-a-Week Watering Restrictions for Pasco County Extended

The Southwest Florida Water Management District (District) Governing Board voted today to extend one-day-per-week watering restrictions for Pasco County until September 1, 2024. This also includes the existing water shortage order currently in effect for Citrus and Hernando counties. The District Governing Board declared a Modified Phase I Water Shortage Order in November 2023 and voted to extend that order in February. Despite having Districtwide above-average rainfall during the winter months (Nov.-Jan.), we still have a Districtwide 12-month rainfall deficit of about 7.4 inches (based on data through May). The 12-month rainfall total through May in the Northern Region of the District matches the historical average, while it is below average in the Southern and Central regions, which includes the Tampa Bay area. June rainfall through June 19 is near the historical average in the Southern Region of the District, while it is below average in the Northern and Central regions. Additionally, Tampa Bay Water’s 15.5-billion-gallon C.W. Bill Young Regional Reservoir is still approximately 12.5 billion gallons below its capacity. Modified Phase I Water Shortage Order does not change allowable watering schedules for most counties, but does prohibit “wasteful and unnecessary” water use. Twice-per-week lawn watering schedules remain in effect except where stricter measures have been imposed by local governments. Residents are asked to check their irrigation systems to ensure they work properly. This means testing and repairing broken pipes and leaks and fixing damaged or tilted sprinkler heads. Residents should also check their irrigation timer to ensure the settings are correct and the rain sensor is working properly. District Extends Watering Restrictions for Pasco County Citrus and Hernando counties and the city of Dunedin have local ordinances that remain on one-day-per-week schedules: - If your address (house number) ends in... - ...0 or 1, water only on Monday - ...2 or 3, water only on Tuesday - ...4 or 5, water only on Wednesday - ...6 or 7, water only on Thursday - ...8 or 9*, water only on Friday * and locations without a discernible address - Unless your city or county already has stricter hours in effect, properties under two acres in size may only water before 8 a.m. or after 6 p.m. - Unless your city or county already has stricter hours in effect, properties two acres or larger may only water before 10 a.m. or after 4 p.m. - Low-volume watering of plants and shrubs (micro-irrigation, soaker hoses, hand watering) is allowed any day and any time. The order also requires local utilities to review and implement procedures for enforcing year-round water conservation measures and water shortage restrictions, including reporting enforcement activity to the District. For additional information about the Modified Phase I Water Shortage Order, visit the District’s website WaterMatters.org/Restrictions. For water-conserving tips, visit WaterMatters.org/Water101. Read the full article

0 notes

Text

Monsoon Showers Drench Jamshedpur, More Rain Expected

Heavy rainfall predicted across Jharkhand districts as weather department issues alerts Jamshedpur residents welcome rain after prolonged dry spell, bringing relief from heat and water scarcity concerns in Kolhan region. JAMSHEDPUR – The steel city recorded 33.8 mm of rainfall on Monday between 8:30 AM and 5:30 PM, offering respite from the recent heat wave. The much-anticipated monsoon showers…

#जनजीवन#Bokaro weather update#East Singhbhum weather#IMD rainfall forecast#Jamshedpur Monsoon#Jamshedpur temperature drop#Jharkhand districts rain warning#Jharkhand rainfall alert#Kolhan region precipitation#Life#monsoon deficit 2024#yellow alert Jharkhand

1 note

·

View note

Text

Heavy Rainfall Alerts for 18 Jharkhand Districts as Cyclone Approaches

Weather Department Warns of Potential Downpours Amid Ongoing Monsoon Deficit Jharkhand braces for heavy rainfall as cyclonic system from Bay of Bengal moves inland, potentially alleviating the 61% monsoon deficit since June 1. RANCHI – The Meteorological Department has issued heavy rainfall warnings for 18 districts in Jharkhand for July 1 and 2, 2024, as a cyclonic system from the Bay of Bengal…

View On WordPress

#Abhishek Anand IMD#मुख्य#cyclone eastern Jharkhand#Featured#Godda weather#heavy rainfall warning#IMD Ranchi#Jharkhand climate patterns#Jharkhand weather alert#monsoon deficit 2024#Santhal Pargana rainfall#yellow alert Jharkhand

1 note

·

View note

Text

Heavy Rainfall Alerts Issued for Jharkhand as Monsoon Intensifies

Meteorological Centre Ranchi Warns of Widespread Precipitation Across Multiple Districts Jharkhand braces for significant rainfall as the Meteorological Centre in Ranchi issues alerts for heavy downpours across the state, signaling a potential turnaround in the monsoon deficit. RANCHI – The Meteorological Centre, Ranchi has issued a series of heavy rain warnings for Jharkhand, indicating an…

View On WordPress

#agricultural impact#राज्य#Daltonganj weather#heavy rain warning#isolated heavy rain#Jharkhand monsoon#Meteorological Centre Ranchi#monsoon 2024#rainfall deficit#state#weather alert Jharkhand#yellow alert Jharkhand

1 note

·

View note

Text

Extreme drought, climate change and criminality drive explosion of fires in Brazil

A huge cloud of thick smoke covers almost all of Brazil. The colors of the mega-biodiverse country that, among other ecosystems, is home to the world’s largest rainforest have given way to gray smoke, and acrid soot. As a resident of São Paulo, the largest Brazilian city, I can’t remember the last time I saw the sky. Unbelievably, this scenario is the same in about 60% of the Brazilian territory.

The situation that led São Paulo and its metropolitan region, according to the IQAir website, to register, earlier this week, the worst air quality among all the world’s metropolises is the result of a combination of climate change impacts and criminal forest burning for land clearance and occupation. At the same time, more than half of Brazil is also suffering the direct impact of the climate crisis, facing our worst drought in the last 44 years. When it comes to fires, the country is about to surpass an astonishing 160,000 fire outbreaks in 2024 – a number 104% higher compared to last year, in which almost 78,000 outbreaks were registered.

According to Cemaden (the National Center for Monitoring and Warning of Natural Disasters), a total of 1,995 Brazilian cities are in a situation of extreme drought, and more than 1,300 municipalities are facing severe drought conditions. It is the first time that a deficit of rainfall has been observed for such a long time, regular rains are expected just for mid-October, in such an extensive area of Brazil – conditions which drives the spread of fires. The fires that spread through practically all Brazilian ecosystems, with the Amazon, the Cerrado and the Pantanal being the most affected, are caused by human action in 90% of the cases.

According to the government, in the first seven months of this year, more than 5.7 million hectares were burned, a growth of 92% compared to 2023. Mato Grosso, Pará, Amazonas and Tocantins, all states in the Legal Amazon, lead the fires. In Mato Grosso, for example, the increase in fires jumped 646%, from 1,400 last year to almost 10,700 this year.

The explosion of fires, as well as coincidences in the burned areas, raises suspicions of criminal and orchestrated acts. In the state of São Paulo, for example, according to information from IPAM (Amazon Environmental Research Institute) 2,600 hot spots were registered between August 22 and 24th, 81% of which were concentrated in areas of agricultural use. The analysis also shows the appearance of columns of smoke in the state in a short interval of 90 minutes, raising even more suspicions about criminal acts.

Continue reading.

#brazil#brazilian politics#politics#environmentalism#environmental justice#climate change#brazil forest fires 2024#image description in alt#mod nise da silveira

10 notes

·

View notes

Text

Bushfires Burn in Victoria

In its seasonal bushfire outlook, Australia’s national council for fire and emergency services warned that severe rainfall deficits spanning 18 months had caused a substantial amount of dead and dry plant material to accumulate in Victoria’s forests, making it easier for fires to start and spread.

In January 2025, the warning became reality in the southeastern Australian state as bushfires raged in Grampians National Park and Little Desert National Park amid hot, dry, and windy conditions. The MODIS (Moderate Resolution Imaging Spectroradiometer) on NASA’s Aqua satellite captured this image of smoke streaming from bushfires burning through parts of the two national parks on January 28, 2025.

The fast-moving fires started on January 27 after dry thunderstorms and lightning struck the region, according to news reports. Unusually high temperatures, which reached above 40 degrees Celsius (104 degrees Fahrenheit), helped fuel the fires. The outbreak follows a similar surge in fire activity that occurred in Victoria in December 2024. At that time, a fire burned in the eastern part of Grampians National Park; this time the burning is centered on the western part of the park.

Victoria officials issued orders on January 29 for residents of Woohlpooer to “leave immediately,” due to increased fire activity on the northwestern edge of the fire. The blaze had crossed a road called Harrops Track and was heading in a northwesterly direction toward Billywing Track. They urged communities surrounding Little Desert National Park to “watch and act,” noting that the fire may travel in a northerly direction toward private properties.

NASA Earth Observatory image by Wanmei Liang, using MODIS data from NASA EOSDIS LANCE and GIBS/Worldview. Story by Adam Voiland.

0 notes

Text

District Declares Modified Phase I Water Shortage

Hillsborough, Pasco and Pinellas counties will be limited to once-per-week lawn watering beginning Dec. 1 District Declares Modified Phase I Water Shortage The Southwest Florida Water Management District (District) Governing Board voted today to declare a Modified Phase I Water Shortage due to ongoing dry conditions throughout the region and increasing water supply concerns. The restrictions apply to all of Citrus, DeSoto, Hardee, Hernando, Hillsborough, Manatee, Pasco, Pinellas, Polk, Sarasota and Sumter counties; portions of Charlotte, Highlands and Lake counties; the City of Dunnellon and The Villages in Marion County; and the portion of Gasparilla Island in Lee County from Nov. 21, 2023 through July 1, 2024. The District received lower than normal rainfall during its summer rainy season and currently has a 9.2-inch districtwide rainfall deficit compared to the average 12-month total. In addition, water levels in the District’s water resources, such as aquifers, rivers and lakes, are beginning to decline. The Modified Phase I Water Shortage Order does not change allowable watering schedules for most counties, however it does prohibit “wasteful and unnecessary” water use and twice-per-week lawn watering schedules remain in effect except where stricter measures have been imposed by local governments. Residents are asked to check their irrigation systems to ensure they are working properly. This means testing and repairing broken pipes and leaks, and fixing damaged or tilted sprinkler heads. Residents should also check their irrigation timer to ensure the settings are correct and the rain sensor is working properly. However, as of Dec. 1, Hillsborough, Pasco and Pinellas counties will be limited to once-per-week lawn watering. These additional restrictions are needed because Tampa Bay Water, which supplies water to most of the three-county area, was unable to completely refill the 15-billion-gallon C.W. Bill Young Regional Reservoir this summer due to the lower-than-normal rainfall. Once-per-week lawn watering days and times are as follows unless your city or county has a different schedule or stricter hours in effect (Citrus, Hernando and Sarasota counties, and the cities of Dunedin and Venice, have local ordinances that remain on one-day-per-week schedules): - If your address (house number) ends in... - ...0 or 1, water only on Monday - ...2 or 3, water only on Tuesday - ...4 or 5, water only on Wednesday - ...6 or 7, water only on Thursday - ...8 or 9*, water only on Friday * and locations without a discernible address - Unless your city or county already has stricter hours in effect, properties under two acres in size may only water before 8 a.m. or after 6 p.m. - Unless your city or county already has stricter hours in effect, properties two acres or larger may only water before 10 a.m. or after 4 p.m. - Low-volume watering of plants and shrubs (micro-irrigation, soaker hoses, hand watering) is allowed any day and any time. The order also requires local utilities to review and implement procedures for enforcing year-round water conservation measures and water shortage restrictions, including reporting enforcement activity to the District. The District also continues to work closely with Tampa Bay Water to ensure a sustainable water supply for the Tampa Bay region. For additional information about the Modified Phase I Water Shortage Order, visit the District’s website WaterMatters.org/Restrictions. For water conserving tips, visit WaterMatters.org/Water101. Read the full article

0 notes